Financial planning isn’t just reserved for the especially wealthy. Whether we’re aware of it or not, all of us are on a financial planning journey and nearly all of us

will want to make the most of our money where we can. Keeping a watchful eye on our financial resilience (our ability to recover quickly from an unexpected financial shock) is an exercise

we should all be doing on a regular basis, rather than something we only think about in times of stress. Whether it’s a change in our circumstances, for example on marriage or divorce or on starting

a family, starting to save for or to take retirement or investing to provide for our children’s education, financial planning can help everyone across all stages of their lives.

It’s hard to plan objectively for ourselves as our financial decisions are often driven by emotion. We might worry that we’re not making the right choices for our family

or feel nervous about making choices we’re not confident about. You can search for products online, but how do you know which ones will provide the best solution for you?

A good financial adviser will get to know you, your circumstances and what you’d like to achieve in terms of your financial goals. Over time, they’ll be there for you

as a trusted partner whose expertise and objectivity you can rely on.

This guide will explain our process in general terms and tell

you what financial planning can achieve. The turmoil brought

about by the Covid-19 outbreak brings into sharp focus the

importance of having a rainy-day fund. There’s also a great

deal of uncertainty regarding how we should act as regards

to our pensions and investments. Since the outbreak, stock

markets have fallen quite dramatically and are, at present,

volatile. You might be thinking about withdrawing funds from

your pensions or investments to prevent further losses, but

is this the right thing to do for your financial future? If your

current financial circumstances allow, should you be thinking

about increasing your contributions to help make up for those

losses instead? It’s at times like these, that the need for expert financial planning is even more crucial.

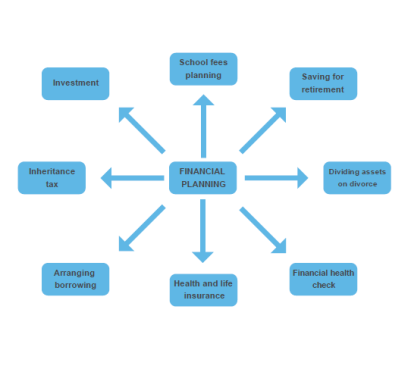

A financial adviser can help you with a broad range of issues

that you might encounter on your financial planning journey,

some of which are shown in the figure to the right:

While everyone’s journey is different, there are a number of key moments in a person’s life when the need for financial planning is more acute. For example, on

becoming a parent, on taking out a mortgage or on reaching the age at which you want to retire. Each person’s circumstances and attitudes are unique. Whatever your reasons for needing financial

advice, it is very important for your adviser to have a thorough understanding of the aims, dreams and issues affecting you and your family.

It is generally best to look at your financial affairs across the board, not just around your initial objective. Your personal circumstances now and in the short and

longer term may well be affected by these decisions. For example, saving to buy a property could have an effect on your broader financial position, potentially affecting your income and expenditure,

and the size of your deposit could impact on your ability to borrow.

The purchase of the property, once the property market is up and running again, could also restrict your disposable income available in the future to meet other

objectives, such as supporting your child at university. Or, if money can be found to pay their living costs in the short to medium term, there may be a longer-term impact in other areas. Maybe you

will reduce pension investment in the short term, which means you have to invest heavily later to keep your retirement plans on track.

The truth is, it can be hard to deal with one issue in isolation, because most areas of financial planning are interconnected. Focused or relatively limited advice,

say on a pension or inheritance tax (IHT) liability, is possible, but a thorough financial review can help you chart your path to your goals.

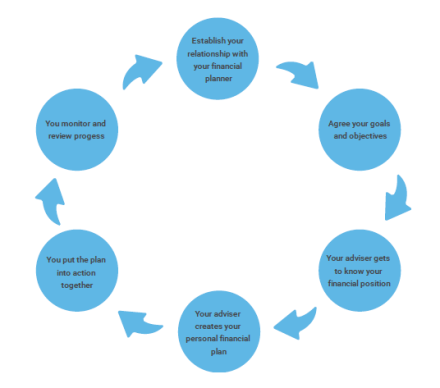

Financial planners follow a simple process. A good planner will use this system to help you achieve your goals.

To the left is the whole process in a nutshell. In some cases, one or more steps might be omitted. For instance, you might simply want a one-off consultation where the

adviser does not monitor your position in the future. You can then return to the adviser for another consultation if you need it, months or even years later. However, an annual review of your

position is generally advised. This is especially true in more troubled or turbulent times.

As a potential client, you should be asking yourself: do I

trust this person and can I work with them? Your adviser will

be acting for you, on your behalf, in your best interests. It is

important to build a long-term, professional relationship where

you are comfortable discussing what can be difficult subjects,

so that you are happy to put you and your family’s future

wellbeing in their hands.

It is worth looking at each of the six steps in more detail,

before we consider one particular aspect of planning – the

investment process.

The first step is for you to get to know the adviser well enough

to decide if you want to take the relationship further. Either in

the initial meeting or soon after, this will involve agreeing the

broad content and scope of the service you need, and crucially how much it will all cost.

The rapport between you and your adviser needs to be right.

Many find the process of giving personal information to an

adviser a little daunting and may feel rather exposed. You may even worry an adviser will pass judgement or make you feel uncomfortable about the previous life and financial decisions that you have

made.

It is important to talk to your adviser and satisfy yourself that

you can trust them with this information. They are there to

offer a professional service, not to pass judgement. It is also important to settle the practicalities: you need to be happy that you have found the right expertise to provide what

you are looking for.

The arrangements all have to be set out formally in the firm’s initial disclosure documentation. The form of these documents will vary from firm to firm, but will

describe key details such as the service to be provided, the frequency of contact with you and how long the agreement will last.

The cost of the service and how it is charged varies between firms and circumstances. There are generally four ways in which you could pay for the services you

need:

- an hourly rate;

- a set fee for a particular piece of work;

- a monthly fee – typically a flat fee or percentage of the investment value to be managed depending on complexity and size;

- an ongoing fee – depending on the ongoing level of service required.

If your arrangements are complex, agreeing a fixed fee once your requirements have been agreed will ensure costs

don’t spiral out of control. In any event, you will be given a clear view of the charging structure to

discuss.

You may be surprised at the amount of information you need

to provide to your new adviser. Think about your own financial

history. You could have savings, investments, property,

mortgages and other loans, wills and other documents,

pensions, life and health insurances, income and expenditure,

tax and much more.

This may be time-consuming to pull together, but it is the

essential start of your relationship. Your adviser’s job is to find

out what you want to achieve with your money now and in

the future. That means gaining a thorough understanding of

your views and history on issues such as borrowing, investing, spending (now and in the future), retirement and estate planning.

You may not have thought about these issues very much and

you might well be encountering some of them for the first time. Many people do not think about their long-term future – at least not in a structured way and not from a financial

perspective.

There will be specific questions about the level of risk you are prepared and able to take on with your investments. These questions will lead to discussions about

how various asset classes have behaved in the past and what they might do in the future. The aim is to build a portfolio of investments that you will be comfortable with, and that will provide the

returns you want and need. This step can take some time and we cover the subject in greater detail below.

It is important not to rush when answering these questions, but to think about how you might feel in certain situations. Of course, it is fine to contact your adviser

for guidance or to ask them questions at this point.

The next step is for the adviser to make sense of all this information, then come up with preliminary conclusions

and initial ideas for your financial plan. Your adviser will complete exercises such as drawing up a balance sheet of your assets and liabilities, making a breakdown of your current income and

expenditure, and calculating your tax liabilities on income, potential capital gains tax (CGT) and IHT.

An important aim of the analysis is to identify potential financial gaps or shortfalls in your future. These could

be gaps between your income and expenditure now and in the future, shortfalls in your pension or insurance provision, or other areaswhere you need to take some action now to bridge the gap between

your goals and your current outcomes.

One of the most powerful tools they will use is long-term

cash flow modelling. This planning technique is designed to

project your future income and expenditure throughout the

whole of your lifetime. Obviously, it includes educated guesses about your future circumstances, but it should be based on reasonable assumptions about things such as your income, and how your

pension and other investments may perform.By its nature it cannot be a precise forecast, but it can clearly demonstrate financial gaps, especially whether – and when – you are likely to run out of money in

retirement.

It is very important to be clear about your priorities – what

might have seemed to be a high priority at the start of the

process might have to be replaced by another need as the

analysis continues.

Cash flow modelling can be a key planning tool for times of

crisis. For example, the financial impact of an unexpected

life event, such as redundancy or long-term ill-health, can be

determined and financial protection (including a rainy day

fund, life and health insurance) put in place. Then, should you

or your family need it, the right amount of money will reach

the right hands at the right time.

Once your needs and wants have been identified, analysed and quantified, it is time for the adviser to do some specific product research into funds, tax-wrappers

(such as ISAs and pensions) and insurance products.

After all this preparation, we get to the formulation of the detailed plan itself. This will contain both the broad strategy and the specific solutions your adviser

recommends.

The suitability report is a key document setting out your objectives, financial gaps, the recommended strategies and specific solutions. The report should be as easy

to read as possible, but there may be a lot to cover and some of it will inevitably have technical or unfamiliar elements.

It is a good idea to meet your adviser face-to-face and spend time going over the report to make sure you understand everything and that it meets your agreed needs and

aims. You should also be happy that the recommendations are suitable for you.

Your adviser can make adjustments to the report in the light of these in-depth discussions, so the plan is not a fixed document. The most important outcome at this

stage is to decide which recommendations you would like to go ahead with.

Now you have a clear plan and set of actions, you can start working on implementing it. It is vital that you understand what is needed on your part and that of the

adviser, to ensure your objectives can be met.

If you are at all unclear or uncertain, it is important to ask. Clients who are not clear about why a certain action is recommended tend not to take that action, and

then the overall plan fails to meet their needs. If in doubt, be sure to ask your adviser.

Financial advisers can generally execute purchases and sales required under a plan on your behalf, as well

as recommending a suitable portfolio of investments. Advisers do also sometimes work with other professionals

such as lawyers and accountants, who can provide specialist legal and tax advice and help with the implementation of

certain aspects of your plan.

Carrying out the agreed recommendations is usually the most straightforward aspect of the planning process, but it can be time-consuming. Pensions need setting up, funds

selling and buying, insurances arranging and trusts settling.

You will probably want your adviser to keep an eye on your investments and other financial arrangements. You and your adviser will agree the extent of monitoring

and review.

For example, you could receive valuations on a quarterly basis, or perhaps more frequently, or you could attend meetings or have phone calls on a regular basis

or on a more ad hoc basis. In any event, ideally you should have some form of meeting with your adviser once or twice a year; perhaps more if you’re concerned about the impact of current

events on your financial wellbeing.

Your review offers you a chance to catch

up with what has changed – either in your own circumstances or in the financial world generally – and discuss things with your adviser.

Much of the groundwork has already been

done, so the review is likely to be shorter and easier to carry out than the initial advice. However, this might not be the case if there have been significant changes in your

circumstances, like a marriage, divorce or a substantial inheritance.

The process for choosing investments is a key part of financial planning and it has its own specific requirements.

Investment aims, risk and resources

A key element of financial planning is for your adviser to understand your aims and attitudes. You might be looking for income, growth or a combination of the two.

What’s more, you might be looking to achieve a specific target level of capital at a future point in time.

Both you and your adviser should be clear how much risk you are prepared and able to take – what is often called your ‘risk profile’. There are three main components to

this risk profile:

● Risk capacity – how much risk you can objectively afford to take. Some people have substantial wealth, so they can wait for a long time before they

need access to their investments or they may not be dependent on their investments. If you are in this position you can normally afford to take more risk than people who have less wealth, need

immediate access to their savings or are highly dependent on income or capital.

● Risk tolerance – how much risk you are psychologically willing to take. Some people are comfortable with investments

fluctuating, while others find it more difficult. One way to gain insight into your attitude to risk is to use a psychometric questionnaire. Financial advisers can follow this up with an indepth

discussion of what your answers say about you.

● Risk need – the amount of risk you need to take, based on the assumptions previously agreed, in order to achieve your stated aims. This amount of risk

may be more or less than you are comfortable with, but it shows you clearly what risk you would need to take. If you are uncomfortable taking on that amount of risk, amendments can be made. You would

need to re-think your objectives and the amount of money you are willing to invest towards them by reducing your expenditure. There are lots of options and your adviser will discuss them all with you

before putting any plan into action.

Asset allocation and fund selection

Asset allocation is by far the biggest factor for a portfolio’s risk and return. How you choose to split your investments between the main asset classes – shares, cash,

bonds and property – will depend on your risk profile and your aims.

Broadly speaking, the more risk deemed appropriate as set out in your plan, the higher the proportion of the portfolio should be allocated to shares.

It is then a question of choosing the right funds within the asset allocation, which could be undertaken in-house or it could be outsourced to a specialist fund manager.

You should also consider if you want to invest in ethical funds and find out more about responsible investment, including how environmental, social and governance (ESG) issues such as climate change

and human rights impact investments.

Consideration should also be given to whether the funds should be held in a particular tax wrapper such as a pension, ISA, or life assurance (investment)

bond.

In theory, you can do everything a financial adviser does yourself. Successful do-it-yourself financial planning is feasible, if you have

the knowledge, time, patience and self-discipline.

If you decide to take on this area yourself, you will need to think about the following:

1. How will you quantify and qualify your objectives? Write down exactly what you are trying to achieve and over what timescale, for example retiring at age 65 on an

income of £20,000 a year net of tax.

2. Have you established how much risk you are prepared to take? You should assign a percentage of assets you need to keep in cash and short-dated investments (for

your rainy day fund and shorter-term objectives), as well as a percentage that you are prepared to put at calculated risk on equity markets.

3. Have you identified how much you have available to invest towards this goal? You might have a lump sum of £10,000, or a monthly investment of £100 a month.

4. How will you assess your existing investments that you intend to use for this objective? Is there enough money in them? Are they the right types of investments for

your objective? Will you be able to access the money when you need it?

5. Which are the best wrappers for tax efficiency? Should you invest in pensions, ISAs or something else?

6. Do you know when you will review your actions taken and results achieved? You should undertake a review regularly and have the discipline to rebalance your

investments back to your original split of cash and equities to ensure the risk you are taking does not increase.

There are lots of good reasons why you probably won’t want to conduct your own financial planning, even if you feel that you’re quite capable of doing

so. It is, after all, a time-consuming process.

There is a lot to learn and keep up to date with. Tax and pension legislation are complicated and constantly changing, as are investments, investment products and

markets. You would have to make clear-sighted, critical decisions on your own, implement and then review them. It’s especially hard to do so in exceptional circumstances, where we find ourselves in

uncharted waters in terms of the economy overall and our own personal finances, which may be less certain than ever before.

It’s not easy to make such big decisions alone. Financial advisers are equipped with the knowledge to undertake their own financial planning, but even they use

colleagues to help them make sensible, objective decisions.

As we’ve outlined in this guide, we’re here to help you through the different stages of your financial planning journey so that you and your family can make the most

of your finances.