Guide to ESG investing

Investing for the future has taken on new meaning in a world of climate emergency, health crisis and awareness of how our actions might affect current and future generations. Environmental, social and governance (ESG) concerns now underpin many investment strategies, to minimise harm to the world and its people while also generating returns.

Profits in polluting sectors and companies reliant on weak labour practices are at risk from greater regulation, making them less attractive in the longer term. ESG

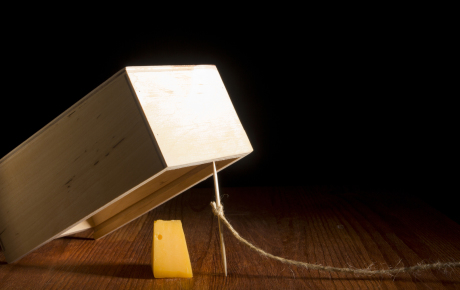

investing aims to future-proof portfolios by backing solutions to finite resources and universal human rights. But navigating these noble aims can be tricky for investors confused by jargon and junk

messaging about supposedly ethical credentials.