Salary sacrifice reform on the way

Although not scheduled to take effect until April 2029, it is important to understand the implications of the changes now.

Salary sacrifice has become an increasingly common way for employees to make their pension contributions, with most major employers offering schemes. It currently has some important advantages for employees over choosing to pay contributions from the after-tax salary:

- There are no employee national insurance contributions (NICs – at up to 8%) on the salary sacrificed.

- Similarly, there are no employer NICs (generally at 15%) on the salary foregone. A part of this saving – or possibly all of it – could find its way into enhancing the pension contribution.

- Full income tax relief is effectively received immediately, whereas, in many instances, tax relief on personal contributions may be only at the basic rate initially, with the balance reclaimed later from HMRC.

While the income tax relief will remain unchanged from 2029/30, the NICs exemptions will be capped on the first £2,000 of sacrificed salary.

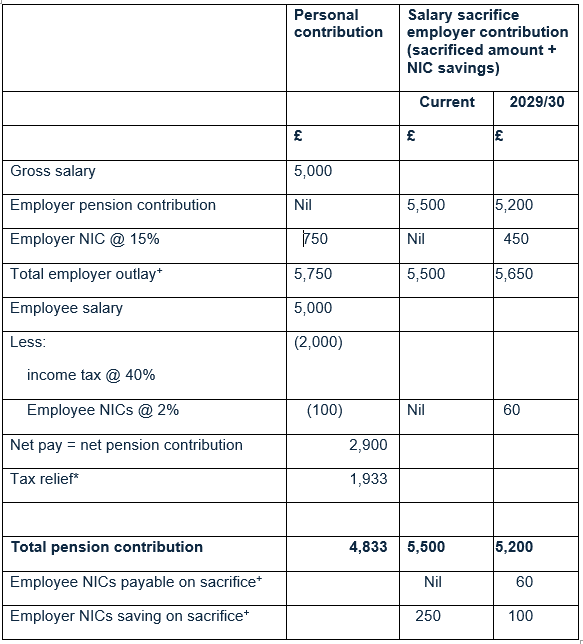

Example of salary sacrifice reform

The example below shows how salary sacrifice works now and how it will work from 2029/30 for a higher rate taxpayer (outside Scotland). The employee chooses to divert £5,000 of their salary to a pension, with their employer putting two-thirds of their NICs saving (10% out of 15%) towards the pension contribution.

+ Employer and employee NICs savings limited to those on the first £2,000 of salary sacrificed in 2029/30.

* Half of the relief is given at source by a net contribution, with the balance then reclaimed from HMRC.

Salary sacrifice is particularly valuable in reducing your income, if:

- You are subject to the high-income child benefit charge, which is triggered when income is above a threshold of £60,000. For couples (married or not), it’s the higher of your two incomes that counts, not the total.

- Your income is in the band between £100,000 and £125,140, where the tapering of your personal allowance means you suffer an effective marginal income tax rate of up to 60% (67.5% in Scotland).

- Your income exceeds £100,000 and you lose entitlement to tax-free childcare. Again, for couples (married or not), it is only the higher of your two incomes that counts.

As these changes won’t take effect until 2029/30, you have four tax years (including the last few months of 2025/26) to possibly benefit from the existing rules, something that you may wish to consider as part of your year-end tax planning.

Notes: The value of the investment and the income from it can fall as well as rise and investors may not get back what they originally invested, even taking into account the tax benefits. Tax treatment varies according to individual circumstances and is subject to change. The Financial Conduct Authority does not regulate tax advice.